“Are you telling me the U.S. can send William Shatner into space and bring him back safely, but we can’t make a gym bag?

– Anonymous Blue Point employee

While media reports of global supply chain movements tend towards the black and white (the U.S. is either prepped for a massive manufacturing renaissance or else its workers doomed to a life of French fry serving), we believe the reality is that each industry has its own particularities and challenges when it decides on sourcing. These decisions are based on a careful weighting of three primary factors – cost, quality and reliability. There has been a meaningful change over recent years in each factor, and the balance between them:

- Cost. Continued wage inflation in China, tariffs and an explosion in logistics costs have significantly altered the total acquisition cost for many imported goods, at least over the near-term.

- Quality. Continued capital investment and labor force maturation in non-China LCCs (low-cost countries) has improved the production quality of lower- and medium-tech goods from other Asian production sites.

- Reliability. COVID-driven shifts in the workforce as well as logistics logjams have altered earlier perceptions of reliability. Current tensions in the U.S.-China relationship are also creating additional points to consider for business owners and managers.

“You don’t miss your water until your well runs dry.”

– William Bell

Our view is that in addition to these changes, there has also been a change in the weighting of each of the three factors. While quality has held its place as a requirement for a given source of supply, the relative weighting of cost versus reliability has shifted considerably, as issues of supply reliability have jumped to the forefront. As COVID and logistical challenges have revealed, a concentrated cost-focused lean supply chain can be a glaring weakness in times of uncertainty. In the Blue Point (BPCP) portfolio currently, as an example, virtually all of our manufacturing and distribution businesses are seeing strong demand; the main governor on growth currently is product availability. Maximizing reliability is key to winning in this environment.

Most current supply chains were developed during the globalization wave from the late 1980s through the first decade of the 2000s, when falling trade barriers and transportation costs removed friction in international commerce. Traditionally, supply chains were designed to take advantage of differences around the world in costs due to labor, materials, energy, and the ability to fulfill customer needs within a particular time and at a specified quality standard. The recent shifts noted above have put pressure on these mature supply chains, causing many business owners to re-evaluate their strategy for the first time in years. As they survey the slate of potential changes, the two options receiving the most attention are:

- Reshoring. The movement of production or procurement back to North America.

- China Plus 1. Lessening dependence on China by relocating some or most of the production to other lower-cost countries, principally in Asia.

Each of these options are the subject of some degree of media hyperbole at the moment. We look both at statistics and examples from our portfolio to separate the reality from the somewhat exaggerated reports.

Reshoring

Broadly speaking, there has been some modest movement in reshoring. While statistics are a bit vague, according to the recent Reshoring Initiatives 1H21 data report (always a compelling read!), the pandemic has spurred some reshoring growth. Reshoring and Foreign Direct Investment (FDI) job announcements for 2021 are projected to be over 220,000, the highest yearly number recorded to date. Put against the context of an estimated thirteen million current manufacturing jobs and nearly twenty million at their peak, however, this is a fairly small change. That figure also overstates the impact of reshoring somewhat, as some portion of jobs related to FDI does not truly represent “reshoring” but simply FDI for another purpose. Nearly one third of that growth (or approximately 70,000 jobs) is estimated to come from products newly deemed essential, where reshoring takes place partly due to strategic importance, such as chips, EV batteries, PPE, pharmaceuticals, rare earth materials, etc. It is occurring and is on the radar of operating executives, but the wave of reshoring appears to be largely the province of editorial pages and business press.

As we see from the earlier quote about Captain Kirk, we believe there are many reasons why reshoring has not been the tsunami some have forecast. In many sectors, the U.S. lacks capacity and expertise and the sub-suppliers necessary given the many years that have passed since production migrated offshore. It sounds strange given our advanced technological prowess, but the U.S. lacks experienced engineers and production workers for many lower- and middle-tech sectors. It can take years or even decades to rebuild that human infrastructure, let alone the sometimes-complex supply chains needed to enable production. Finally, with a labor cost still far in excess of many LCCs, the U.S. is simply still not cost competitive. We have seen these stories play out in our portfolio as well with extremely modest re-shoring impacts.

We think that in certain cases, reshoring will become more prevalent. For certain core, strategic sectors, economic logic may take a backseat. COVID has laid bare for many the importance of having domestic supply of PPE and pharmaceuticals as an example. For most sectors, however, cost considerations, skill gaps and supply chain holes will make reshoring in the near to medium-term unlikely. This is not a static analysis though, and world-class supply chain organizations are going to need to evaluate their supply strategies on an on-going basis.

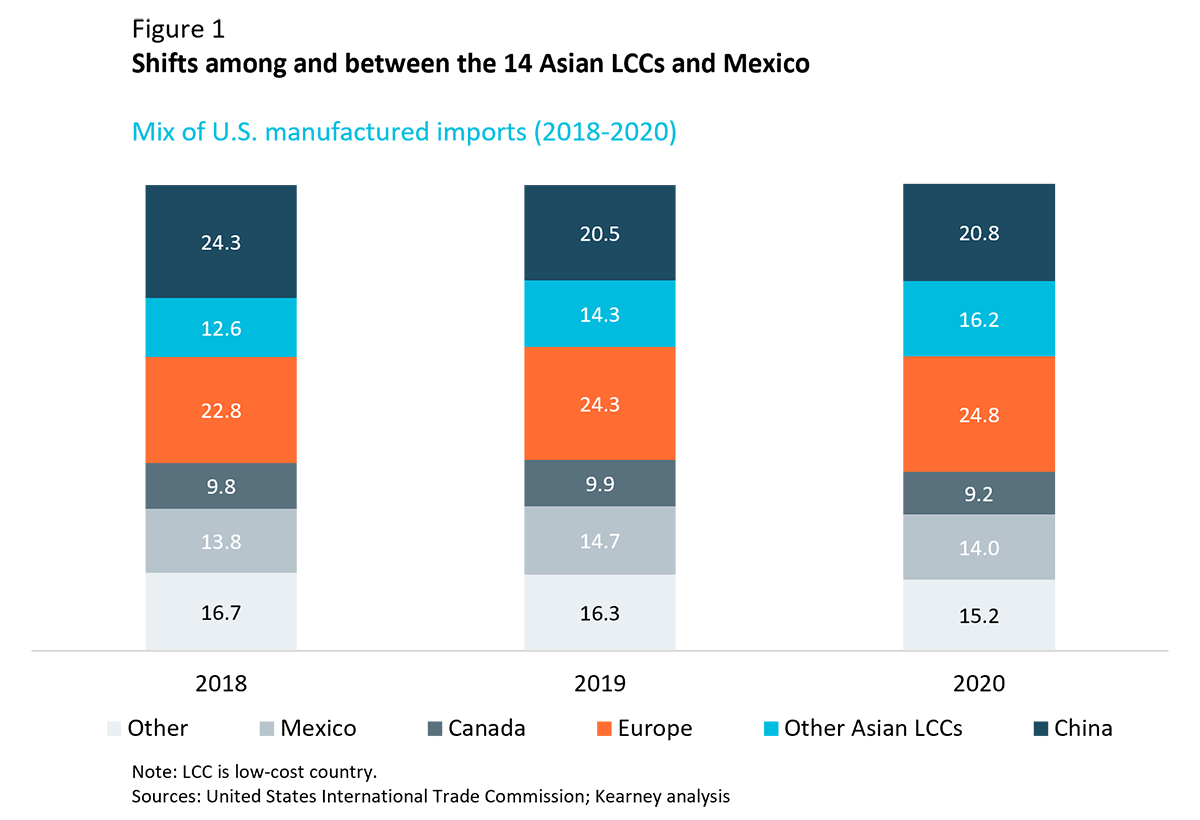

While reshoring may not be living up to its hype yet, we continue to see a meaningful increase in China Plus 1 strategies, where companies are lessening their dependence on China and increasing exposure to other LCCs. This movement was gaining steam in the early 2010s but got a major push from U.S. tariffs and increasing Chinese production costs in the last five years. As we observed in our prior investment of an insole producer, Vietnam produced 29% of a leading brand’s footwear in 2006 compared to 31% in China. By 2017, Vietnam accounted for nearly 50% of the brand’s manufacturing. Several types of production are partly relocating to different markets to take advantage of the diverse benefits of Southeast Asian countries. For example, high-labor manufacturing is the most cost-effective in low-wage countries, such as Vietnam, Cambodia, India and Bangladesh. Conversely, electronics manufacturing relies on technology-specific infrastructure, supply chain networks and high-volume production benefits in countries such as Malaysia. While COVID’s impact on production sites has muddied the analysis a bit, the chart below from Kearney clearly illustrates this shift. As a percent of total manufactured imports to the U.S., China has lost nearly 3.50% in the past two years. In that same period, other Asian LCCs increased by a nearly identical percentage. Interestingly, the percent of imports coming from Mexico, another often discussed alternative, saw very little change.

Again, we see these shifts playing out in living color at those companies in our portfolio that are engaged in manufacturing or distribution. Our companies are actively sourcing in Vietnam, Cambodia, Malaysia, Taiwan, South Korea and India in addition to China. Many of these programs were relocated from 100% China sourced in order to reduce total landed costs, improve supply reliability or both.

For the roughly half of the BPCP portfolio that is engaged in either manufacturing or distribution, supply chain has moved to the top of board agendas during the COVID era. Dennis Wu and our supply chain team have been working closely with each company to navigate this evolving challenge.

Like the shift that occurred in the ‘90s and ‘00s, supply chains are very much in flux at the moment. We believe that understanding the options and being capable of navigating them is a critical advantage to driving growth. The evolution of the global supply chain has and will continue to create a number of opportunities for many businesses. Churchill once said, “An optimist sees opportunity in every difficulty.” While that is true of the current supply chain difficulties, we believe it takes information, knowledge and experience to seize it.